Do you earn money as gig worker but feel unsure whether you’re handling your taxes correctly?

Introducing the Tax Guide for the Gig Worker!

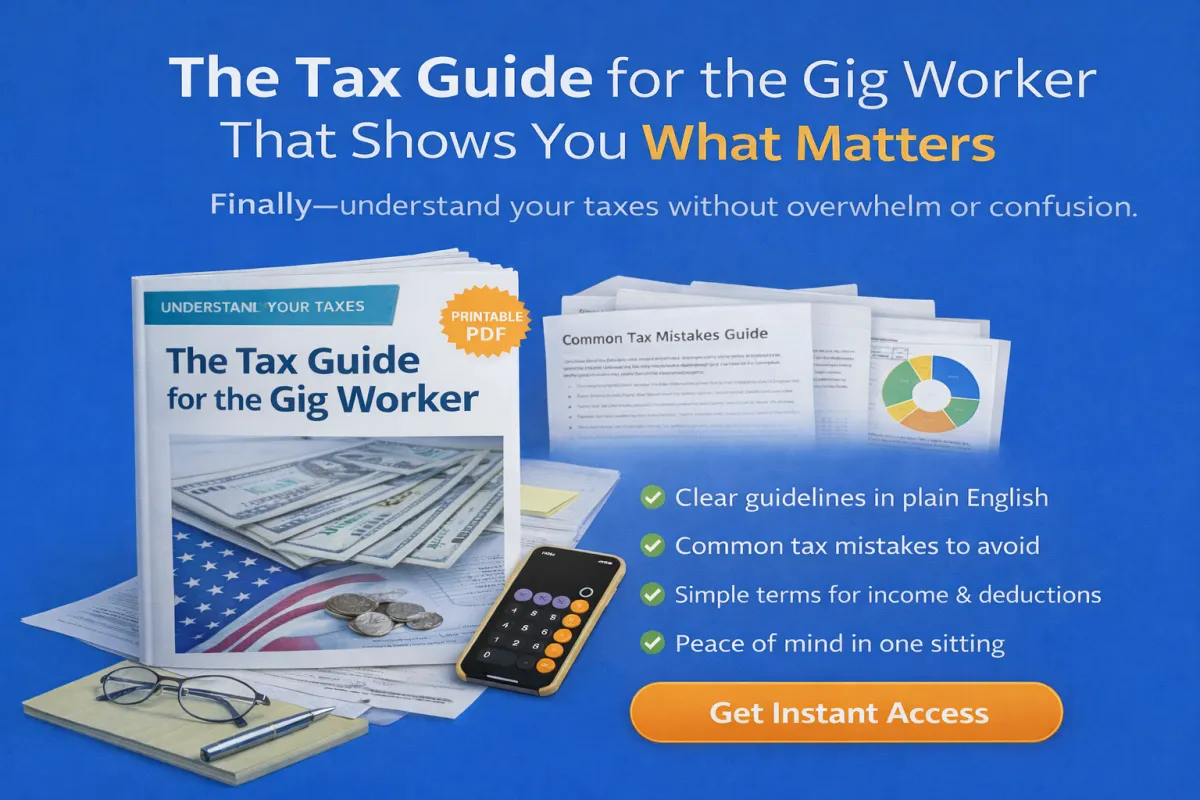

A complete step-by-step tax guide designed for gig workers who want clarity — not confusion — and real control over their money.

Whether your income comes from content creation, ride share platforms, gigs or e-commerce - filing taxes becomes simple when you’re organized and prepared. Don’t get treated like just another name on a tax preparer’s client list — or worse, overcharged for work you could confidently understand and do yourself.

Do Your Own Taxes — Correctly, Confidently, and Without Paying a Tax Preparer Hundreds (or Thousands)

Taxes for Content Creators, Finally Explained

Taxation Education from a tax professional with 30+ years experience with multiple side hustles!

The Tax Rules Have Changed — Here’s What Content Creators Need to Know

What's Included:

• Track your income and expenses efficiently

• Claim every deduction you qualify for

• Handle self-employment tax without fear

• Pay estimated taxes the easy way

• Protect yourself from audits

You’re Earning the Money — Now Learn How to Protect It!

Privacy Policy Return Policy | Terms of Use

© TaxationEducation2026, All Rights Reserved.